ESG Reporting: 5 Top Tips to get started

What is ESG?

Environmental, social and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments.

ESG reporting goes above and beyond a company’s usual financial and even sustainability reporting, and should reflect its overall business objectives and align with its vision, mission and values.

But if you are only just starting out on your journey, where should you begin?

EnviroSustain’s Top five ESG reporting tips:

1. Establish an ESG Strategy

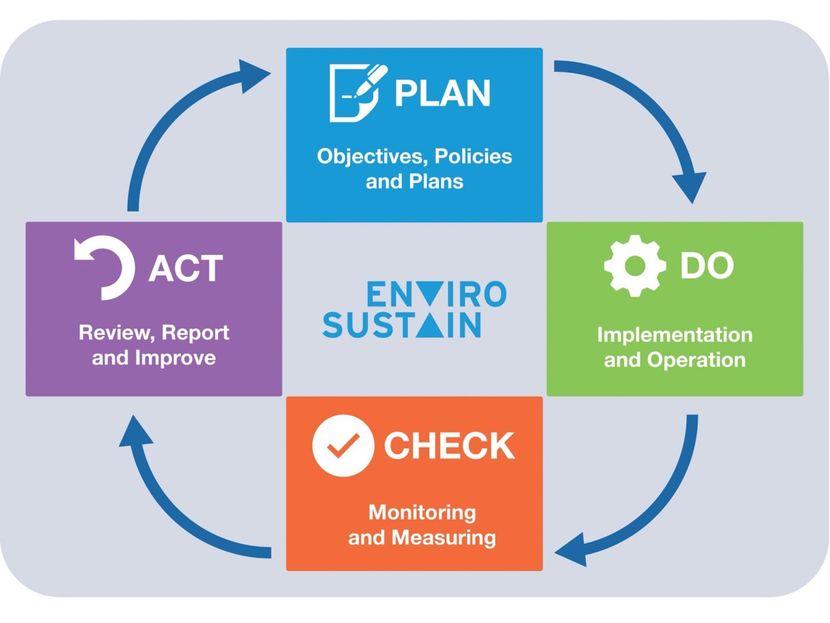

The reporting on emissions deriving from office, retail or other type of service buildings is just emerging. Therefore, it’s important to start by putting a sound strategy in place. Like any management system, following an ESG strategy means continuous improvement over time. A good ESG strategy typically follows these principles:

PLAN

Establish objectives and draft your plans (analyse your organisation’s current systems, establish overall objectives, set interim targets for review and develop plans to achieve them)

DO

Implement your plans within a structured management framework

CHECK

Measure and monitor your actual results against your planned objectives

ACT

Correct and improve your plans to meet and exceed your planned results

(ISO 14001). WHAT IS THIS

2. Decide on your reporting framework(s)

There are a whole host of reporting frameworks, standards and guidelines out there, and it may be difficult to know which one to pick.

Some, such as Global Reporting Initiative (GRI) and Sustainable Development Goals (SDGs) are not industry specific. Some may be topic specific, such as International Standards Organisation (ISO). There are also those specific to climate change, such as Task Force on Climate-related Financial Disclosures (TCFD) for example.

GRESB is a standard which is specific to the real estate industry investors and customers and forms the basis for much of the reporting in these types of company. It provides ESG performance assessment of real assets globally, including read estate portfolios and infrastructure assets.

There is no one-size-fits-all approach and it will depend on your organisation’s needs to report, what they want to report, and who they are reporting to. Do your research, or speak with a consultant with specialist knowledge of your industry.

3. Ensure reliability of your data

For your reporting to be accurate, your data needs to be accurate. At EnviroSustain, we have seen the struggle to accurately collect and report quality sustainability/ESG data due to various systems and software having proved to be insufficient for the task at hand.

In November 2019, ES partnered with Measurabl - the world’s most widely adopted ESG data management platform for commercial real estate and multi-building tenants. We know we have found the right system, both for our consultants and, more importantly, our clients. However, whichever system or software you use, it’s important to ensure the quality and validity of your data.

As part of its ongoing commitment to data quality, GRESB initiated a Technical Working Group (TWG) in late 2018 with the goal of developing a GRESB Performance Data Standard. Measurabl are the Founding Partner of the TWG, in recognition of their leadership in calculating and assuring ESG data quality.

4. Ensure transparency in your reporting

ESG reports and disclosures are increasingly taken into account in investment decision making, so it’s important to make sure that you are reporting accurately and transparently to your stakeholders.

A

recent report suggested considering the following:

- Develop consistent and controlled policies for quantifying and reporting purpose-led metrics.

- Align metrics reported externally with those used by management in running the business.

- Organise metrics in a systematic way. Consider the use of technology to make the information interactive and engaging.

- Offer comparison figures to demonstrate consistency.

- Determine the appropriate format and how frequently to report.

- Implement controls over the preparation and reporting of purpose-led metrics with the same rigor as controls over traditional financial reporting.

- Provide context - the most relevant metrics consider the entity’s industry and markets.

In addition to these, ensure the metrics applied are SMART (Specific, Measurable, Achievable, Realistic, Timescale), this provides a simple foundation to demonstrate progress and improvement. This can also be utilised to align actual management and operation of the business with ESG targets, providing the granular and contextual background to your companies’ sustainability activities and reporting requirements.

5. Just get started!

Driven by emerging themes like social value and impact investing, coupled with the highlighted concerns for the climate crisis and net zero targets, ESG is rising up the board agenda.

There’s really nothing else for it but to get started. Once you have your strategy in place and a framework to work to, it really is a matter of getting to work.

Don’t forget: there’s always someone out there who can help, including our experts here at EnviroSustain. So please do feel free to get in touch with us if you need any support, or just have questions.

Head Office, Berlin,

Neue Grünstraße 17 | 18 Hof 1 | TRH 3

10179 Berlin

© ES EnviroSustain GmbH 2021