Case Study:

PATRIZIA PANEUROPEAN ACHIEVES GRESB FIVE-STAR RATING AND COMES FIRST WITHIN ITS PEER GROUP FOR 2020

CLIENT NAME:

PATRIZIA PanEuropean PLP

ES SERVICE:

ESG strategies and implementation, GRESB Reporting and Consultancy, ESG Due Diligence, Green Building Certifications, Energy consulting

BUILDING NAME & LOCATION:

Augsburg, Germany

TYPE:

N/A

CONSTRUCTED:

N/A

FLOORSPACE / AREA:

N/A

PATRIZIA PANEUROPEAN ACHIEVES GRESB FIVE-STAR RATING AND COMES FIRST WITHIN ITS PEER GROUP FOR 2020

ABOUT THE PROJECT

PATRIZIA, headquartered in Augsburg, has been an active real estate investment manager across Europe for more than 35 years.

PATRIZIA has a strong commitment to ESG, which is championed at the most senior levels of the business. GRESB reporting forms a key part of PATRIZIA PanEuropean’s ESG strategy, enabling the Fund to monitor and improve sustainability performance.

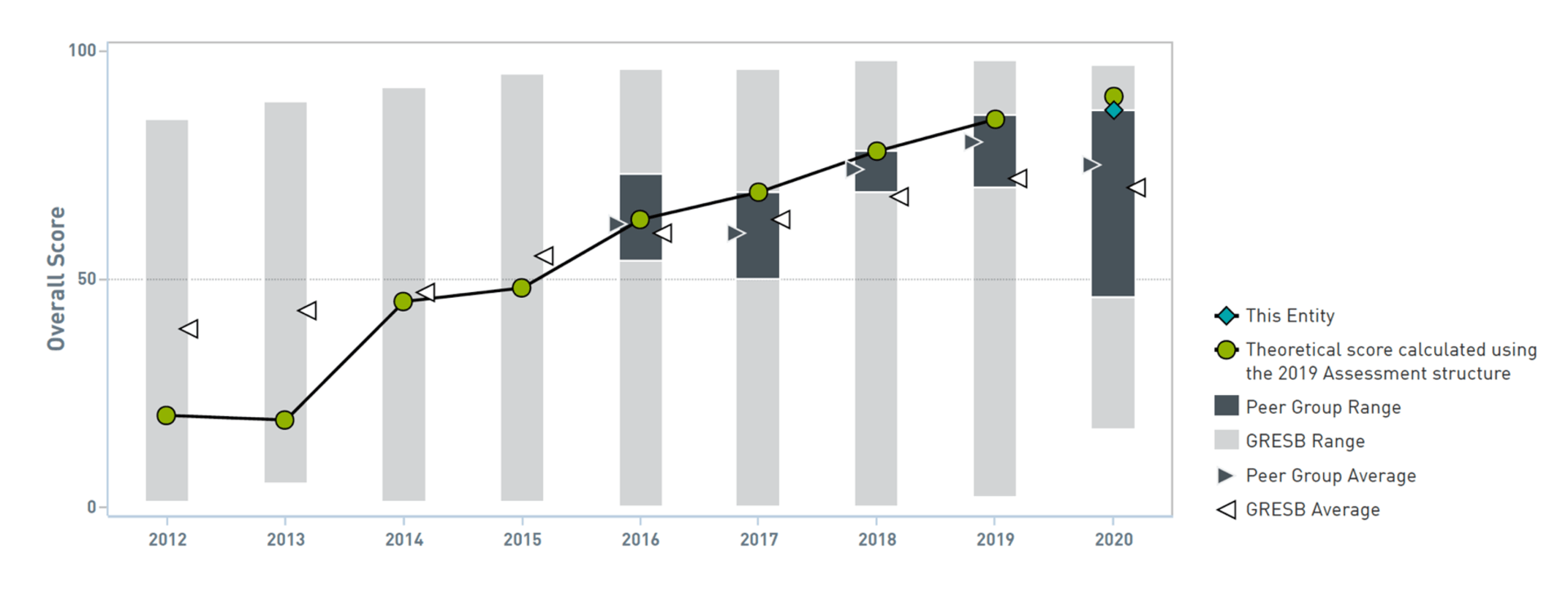

EnviroSustain has been supporting PATRIZIA PanEuropean with GRESB reporting since 2016. The objective was to improve the Fund’s GRESB score year-on-year with the aim of achieving a five-star rating.

OUR APPROACH

A key factor in our work is the trusted relationship that we have built with PATRIZIA.

The ongoing relationship means that we can help them adopt a cycle of continuous improvement. Using the GRESB process and scoring, we provide feedback and recommendations to support their ESG strategy and improve their GRESB score year-on-year. This also provides them with furthering their ESG goals and objectives.

It also allows us to effectively engage their ESG Committee and the wider organisation in order to gather all of the information needed to effectively complete the GRESB assessment which encompasses:

- ESG consulting on organisational and fund-level to implement the ESG objectives set out in the fund’s ESG policy following an ESG action plan

- ESG education of the stakeholders involved

- Collecting and analysing asset-level data such as energy and water consumption and amount of waste

- Calculating the carbon footprint on fund- and asset-level and assess potential stranding risks

- Tracking year-on-year improvement on fund- and asset-level

- Conducting ESG due diligence and certification of operational building performance (e. g. BREEAM In-Use) to improve asset-level performance

KEY OUTCOMES

EnviroSustain has supported the fund to achieve:

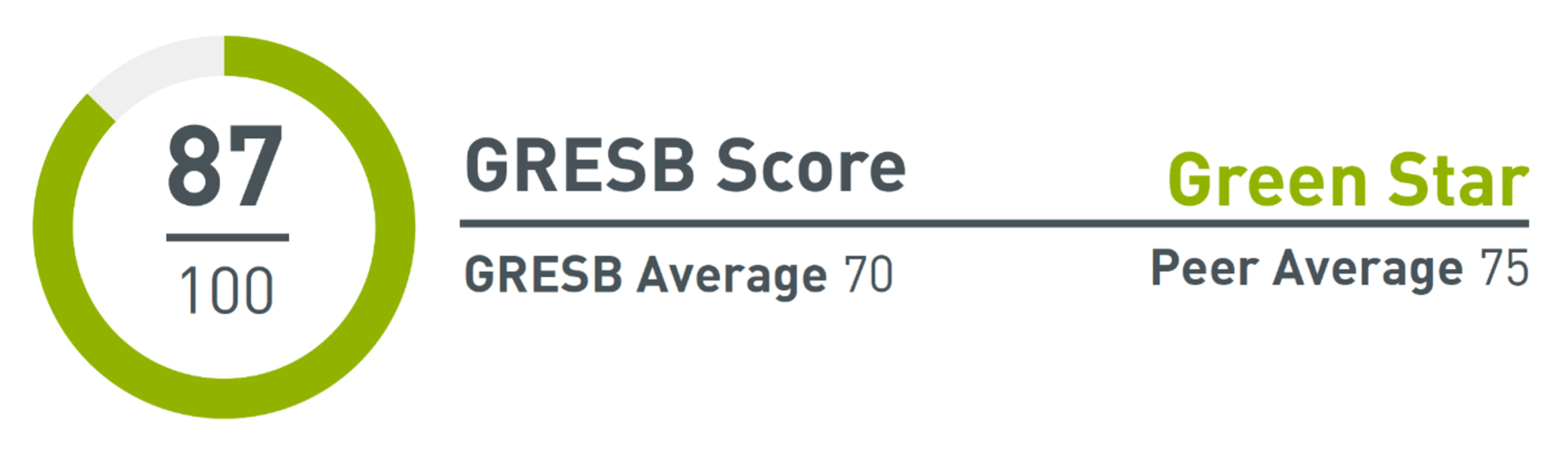

- Year-on-year GRESB score improvements

- First in peer group for 2020 (Western Europe | Diversified – Office/Retail | Core)

- GRESB 5 star fund

- 87% GRESB score (Peer average 75%)

- Above GRESB and Benchmark average in all ESG components

BACK TO ALL CASE STUDIES

Head Office, Berlin,

Neue Grünstraße 17 | 18 Hof 1 | TRH 3

10179 Berlin

© ES EnviroSustain GmbH 2021